Note: In the event you got to this article from an older link, here is a link to the newest data for this category of monthly home sales in Kitsap County

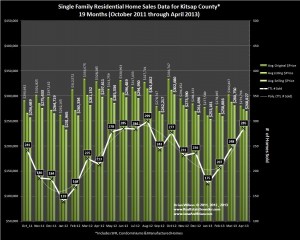

There were 285 closed home sales in Kitsap County during April 2013 which is just a few homes shy of a record number of monthly sales looking back as far as October of 2009. In the time since then, the only month with more sales was August of 2012 with 299 homes Sold. On average during the previous 12 months, about 250 homes were sold every month in Kitsap County.

The median selling price for the 285 homes sold during April was $226,000 which is about 3.8% less than during the same period one year ago. However; for some perspective, the monthly median selling price for homes sold during the previous year has varied monthly from a low of $214,500 in February 2013 to a high of $250,000 during August of 2012 with an average for the monthly median coming in at $230,400 over the previous 12 months.

The average selling price for homes sold during April 2013 was about $269,000

Another important data set is that of distressed properties. Of the total homes sold during April, ~25% of them were distressed sales, with bank owned foreclosures (REO’s) comprising 15% and Short Sales comprising about 10%. This is about the same rate we’ve seen recently, and about in line with the monthly percentage of distressed sales we’ve seen over the previous year. So while some market areas like Poulsbo and Bainbridge Island are seeing declining numbers of distressed sales, county-wide the number of distressed home sales continue to be in a range from about a low of 20% to a high of over 35%.

We are noticing a significant shift in the composition of distressed properties sold in Kitsap County. For the first time for as far back as our data goes, we are seeing Short Sales comprising a larger percentage of distressed sales than REO’s (bank owned foreclosures). Of the month-to-date sold properties 14% are closed Short Sales and only11% are REO’s. This is the first time there are more Short Sales than REO’s. A review of the “Pending Sales” data shows an even more impressive shift: 13% are REO’s while 23% are Short Sales! This is almost a 100% reversal of the composition of distressed sales data going back as far as 2009! We will certainly be watching to see if it continues. There may be many factors involved in the apparent shift in the data, but this may finally indicate a meaningful change, with lenders making a bigger good faith effort to close short sales rather than go to foreclosure. Wow!

So far, during the month of May through 5/20, there have been 168 closed sales and the median selling price for these closed sales has increased nearly $10,000 or just over 4% from the April median to $240,000, while the average has declined slightly to about $264,500. Overall, home prices in Kitsap County appear to be stable but biased toward increasing and we will be tracking this data closely every month.

Some of the significant factors affecting home prices are the quantity of new home sales which generally have been priced below the average resale home price and the number of distressed home sales which have also typically been priced below market. With some areas in the County seeing a decline in the quantity of distressed properties and with rapidly increasing new home prices, the bias moving forward appears to be toward increasing home prices.

As for current and future sales activity, there is a tsunami of home sales in Kitsap County. Currently as of May 20, 2013 there are 910 homes under contract as Pending or Contingent home sales. Adding the current month-t0-date sales to the resale homes that have been “Pending” prior to April 15, it appears there should be a record number of closed sales for the month of May, which we estimate will be over 350 and may surprise to the upside nearing 400 or more!

New home sales in the County comprise about 17% of the total pending backlog and distressed home sales (REO’s & Short Sales) comprise about 36%, which is at the high end of the range we’ve seen over the previous year. Because of the long time it takes for distressed properties to close (mostly the Short Sales are the big problem), they do tend to comprise a higher proportion of the pending sales as they accumulate over a longer time while non distressed properties close much more quickly (about 45 days). With the new construction cycle running at about 5 months and Short Sales taking anywhere from 3-6 months or more….a lot of the Pending backlog will be closing over an extended period of time.

Thank You for visiting our blog. We hope you will bookmark it in your browser and come back often, or we invite you to ![]() Get the RSS feed

Get the RSS feed

Brian Wilson, Broker; mobile: 360-689-2466

-and-

Jana Salmans, Managing Broker; mobile: 360-509-9684

John L. Scott Real Estate

19723 10th Ave NE; Suite 200

Poulsbo, WA 98370

Speak Your Mind